Folsom, Calif. –(March 7, 2025) – Preschoolers from Antelope, Citrus Heights, Fair Oaks, Rio Linda and Roseville received a special behind-the-scenes visit at SAFE Credit Union’s Antelope branch.

The ninth annual VIP tour and financial education event brought Antelope’s Play With Me Preschool children and their families to the branch.

Preschoolers learned the basics about money, toured the vault, and interacted one-on-one with a branch teller to sign the withdrawal keypad to receive a $1 bill. They used the cash toward buying a treat at nearby Yogurt Time.

Nora Elmer, 4, reaches for her dollar at the teller window at SAFE Credit Union's Antelope branch.

Nora Elmer, 4, reaches for her dollar at the teller window at SAFE Credit Union's Antelope branch.

“It was truly heartwarming to welcome the kids and their parents and to see the excitement on the kids' faces as they built up their financial awareness through the tour and the hands-on withdrawal experience,” says SAFE Credit Union Antelope Branch Manager Avi Naidu.

SAFE’s Training Branch Manager Avi Naidu helps a field trip attendee with a signature pad.

SAFE’s Training Branch Manager Avi Naidu helps a field trip attendee with a signature pad.

SAFE Credit Union, a not-for-profit financial institution, shares in the credit union cooperative principle of sharing profits within communities through financial education.

“Parker’s favorite part of the field trip was signing his name on the electronic pad,” says mom Connie Broome. “He enjoyed being able to act like a grown-up at the teller stand.”

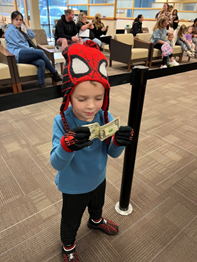

Parker Broome, 4, examines his recently withdrawn dollar bill at SAFE Credit Union's Antelope branch.

Parker Broome, 4, examines his recently withdrawn dollar bill at SAFE Credit Union's Antelope branch.

Parent Jennifer Martindale says it was her daughter Riley’s first trip to a bank and that she especially “liked getting her dollar.”

“I like all of the money,” says Riley, 4. “I liked seeing the bank safe the most.”

Martindale says Riley’s full experience culminated with Riley using her dollar toward buying a vanilla yogurt with gummy worms and crumbled Oreos.

“I think she listened and learned more about money than ever before,” Martindale says. “Having to put your money into the safe and going to the bank in order to pull it out – she learned about where money (actually) goes.”

SAFE Credit Union’s Training Branch Assistant Manager Janet Steele interacts with a preschooler from Play With Me Preschool.

SAFE Credit Union’s Training Branch Assistant Manager Janet Steele interacts with a preschooler from Play With Me Preschool.

SAFE Credit Union’s Vice President Retail Branches Janine Southwick says the branch and retail staff created a supporting and welcoming environment for families.

“We feel so fortunate to have been able to welcome our smallest of members in the community into our Antelope branch for their first in-person lesson in banking,” says Southwick. “I’m so proud of our branch and retail teams for creating such a fun-filled and educational environment for these preschoolers.”

Members of SAFE’s financial education team introduced students to how money works and gave them each a Mr. SAFE piggy bank.

SAFE Credit Union Community Relationship Specialist Miriam Dougherty explained to the preschoolers how saving money in their new piggy banks will help them buy things later.

She offered parents advice on how to talk with their kids about money.

“One significant mistake is not talking with your kids about money at all, or if you do, it may be in a negative way,” advises Dougherty, a certified financial educator. “It’s OK to be honest about money but at the same time it’s best to do it in a healthy way that can start with explaining to children the difference between wants versus needs.”

Along with facilitating special educational events, SAFE’s financial education team regularly conducts Budget Cents programs for teens at area high schools and at juvenile detention centers through a partnership with Sacramento County Department Education. Each financial literacy lesson starts by giving students mock budgets and incomes to learn how to manage.

For more information email [email protected].

###

About SAFE

SAFE Credit Union has made members an integral part of its vision since 1940. Over the years the credit union has kept the focus on what really matters, putting members first, a formula that has seen SAFE grow into a leading financial institution in Northern California with $4.3 billion in assets and about 236,000 members. SAFE crafts every cutting-edge product and sterling service with members’ needs foremost in mind. In addition to banking services conveniently available through online, chat, mobile, or phone options, SAFE offers in-person services for members and small businesses at